We all wish a bright future for our loved ones. Hopefully we'll continue to be a big part of their story, but when a life is suddenly cut short, those left behind can often be left with an altogether darker prospect ahead.

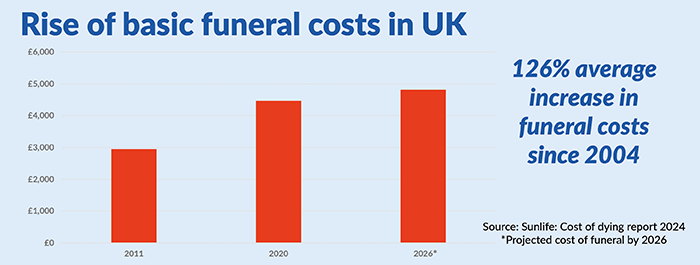

Our Life Cover can help light the way forward and that starts straight away. The policy pays up to £50,000 if you die during the policy term, which can be used to cover immediate expenses, such as funeral costs. The policy covers death from any cause after the first 2 years, you will be covered immediately for accidental death subject to the exclusions.

Life insurance applications are typically underwritten. What this means is you will have to answer questions about your health, family history, height, weight and even how often you go to the gym. In some cases, you may also have to complete medical tests. Based on your responses and results, you could get more cover at a cheaper price or you could possibly get declined cover.

With our guaranteed acceptance Life Cover, as long as you are a UK resident aged between 18 and 64, you already qualify for the cover. This means no long medical questionnaire to complete, so getting protected is quick and easy.

Here’s what one of our customers Deborah said:

"Everywhere else I’d gone you had to fill in a lengthy medical questionnaire, question after question about what were your medications, how ill had you been…to not have to fill in that questionnaire about anything, was absolutely wonderful”

With so much else to deal with at this difficult time, sorting the short-term finances for your partner or children is just the first step towards getting their lives back on track.

But it's not the only way this Life Cover can help them. It can also be a longer-term solution for any family who would struggle to pay bills, meet mortgage repayments, bring up the kids and keep meals on the table without your regular income.

It's about helping to keep things ticking over. It's about helping to take care of them, even when you're not around. It's about telling them you still love them.

What's Covered:

• A cash lump sum payout of between £10,000 and £50,000 if you die during the policy term

• Covers death from any cause after the first 2 years (you will be covered immediately for accidental death subject to the exclusions listed below)

• Guaranteed acceptance - as long as you're a UK resident and are aged between 18 to 64 at the policy start date, you’ll be covered with no medical questions asked

• Monthly cover until the first premium due date following your 69th birthday (following this cover will end and no cash lump sums will be payable)

• Premiums stay the same throughout your cover

What's Not Covered:

Accidental death is covered from day 1 subject to certain exclusions listed below. If you die within the first 2 years of natural causes including illness or from an accident where no claim is payable, all premiums you have paid will be refunded but no lump sum is payable.

Once you have held the policy for 2 years ANY cause of death is covered with no exclusions whatsoever.

Accidental death exclusions (first 2 years only):

• Self-inflicted injury, suicide or attempted suicide by You, regardless of the state of Your mental health;

• Participating in any criminal act;

• Participating in hazardous hobbies and pastimes; (Meaning engaging in private aviation, parachuting, motor sports (including motorcars, motorcycles and speedboats), sports underwater diving, caving/ potholing or mountaineering (other than hill walking, trekking, abseiling or artificial wall climbing);

• War (whether declared or not), riot or civil commotion;

• Taking drugs (unless these were prescribed by a UK registered Medical professional);

• Reckless consumption of alcohol (Consumption of alcohol such that it results in mental or physical impairment which causes the accident or results in you doing something you would not normally do without the influence of alcohol).

Things to Consider:

- Cover ends at age 69

- Accidental death cover only for the first 2 years

- There is no cash-in value at any time

- The value of the cash lump sum may reduce with inflation

- Your chosen level of cover meets your needs

This policy is underwritten by Scottish Friendly Assurance Society Limited. For a full explanation of the terms and conditions please read the policy documents carefully in the policy docs tab.