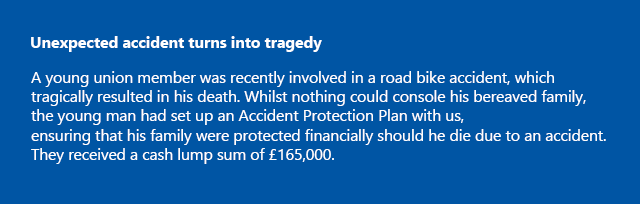

This Accident Protection Plan provides you with a daily cash pay out should you end up in hospital as the result of an accident or if the worst was to happen, it provides a lump sum benefit to your loved ones in the event of your accidental death.

What’s covered?

• Accidental Death - £150,000 cash lump sum payout should you die as the result of an accident;

• Accident Hospitalisation - £300 per day if you are admitted to hospital as an inpatient for more than 24 hours, as the result of an accident (Up to a maximum of 180 days across all claims during the lifetime of the policy).

As long as you (and your partner, if covered on the policy) are UK residents and aged 18 to 69 then acceptance is guaranteed and there are no medicals or questionnaires to complete. You can be covered until you reach age 70.

You can enjoy peace of mind knowing your insurance is in place 24 hours a day, every day – even if you’re travelling abroad.

The plan is designed to keep up with rising costs, so to ensure that your cover maintains its value your benefits and premiums are automatically increased by 5% each year, until the maximum benefits are reached - £200,000 for the Accidental Death benefit and £400 per night for the Accident Hospitalisation benefit. Premiums do not increase with age.

What’s not covered?

Death or hospitalisation as a result of:

• natural causes or suicide;

• consumption of excessive alcohol or use of illegal drugs;

• an illegal or reckless act on your part;

• while on duty as a member of the Armed Forces or as a member of the reserve forces;

• any flying activity other than on a registered commercial airline;

• war or any act of war;

• competing in any kind of race other than on foot or while swimming;

• participating in diving, underwater diving, mountaineering / rock climbing, potholing or parachuting;

• motorcycling (including riding mopeds and motor tricycles) as a driver or a passenger.

For a full explanation of the terms and conditions, please read the policy documents carefully. You can find these on the “Policy Docs” tab.

The plan is underwritten by Stonebridge International Insurance Ltd, authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority, register number 203188. Union Income Benefit Holdings Ltd and Stonebridge International Insurance Ltd are both members of the same group of Companies and are ultimately owned and controlled by the Parent Company Embignell Ltd, registered in England no 05871053.